How I Aligned My Values By Investing In A Greener Future

/Source: Robinhood Markets, Inc., My 2020 Recap

Investing Experience

I started investing a few years ago because I believe the stock market offers a unique opportunity to create long-term wealth. I have seen first-hand diligent and long-term investors in my family build wealth and wanted to take a more hands-on approach. As any novice investor, I follow investment blogs, news, and read books, and one piece of advice really resonated with me.

“Know what you own, and know why you own it.”

If we think about it, an average investor like me and you, actually know quite a bit about companies that we all interact with every day. We may not understand all the financial aspects (though they are not that difficult to learn) but we are familiar with attributes like customer loyalty, market share, leadership, and other aspects that fuel the growth of a company. My first investment was in the blue-chip technology company Apple (NASDAQ: AAPL) - I have been using Apple products for over a decade.

Given my background in sustainability and renewable energy, I started looking out for socially responsible investment (SRI) opportunities in companies that are contributing to combating climate change. I gravitated towards the renewable energy sector, particularly solar as it’s a technology that I have used the most to reduce the carbon footprint of my real estate projects. According to the Solar Energy Industries Association (SEIA) and Wood Mackenzie, solar accounts for 43% of all new electric generating capacity additions in the U.S. through Q3 2020, representing 43% year-over-year growth from 2019. One of the most profitable parts of any solar installation is its components that keep the energy flowing to the power grid - “inverters”, converting the direct-current (DC) electricity produced by solar panels to alternating current (AC) to be carried into homes or sent to local power grids.

Investment Thesis

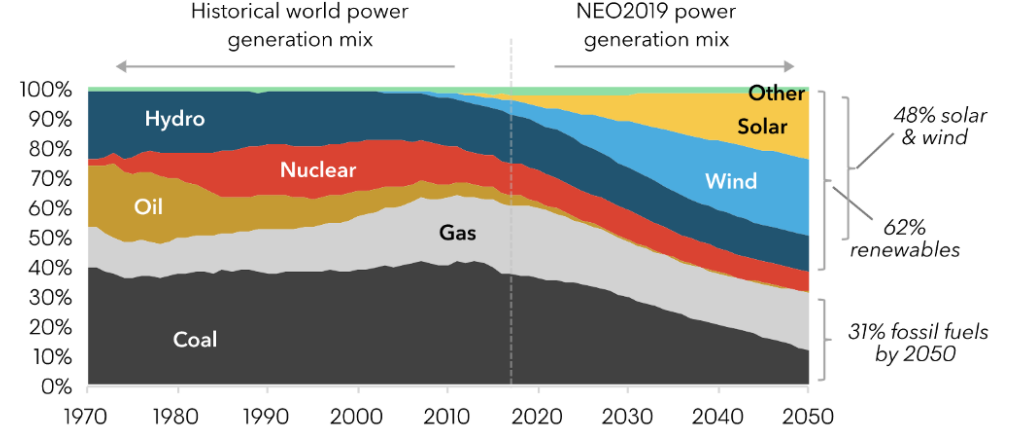

The cost of solar has declined 75% since 2010 and is expected to get cheaper than most other renewable sources, achieving grid parity in many countries (the Levelized cost of producing power is equal to or less than the price of power from the utility grid). The International Energy Agency (IEA) also predicts that installed solar will overtake other forms of energy, apart from gas, by 2040. The economics are enabling solar installations on small homes to large-scale utility projects, making it an accessible, cost-effective solution to combat climate change.

Source: Bloomberg NEF

SolarEdge is a market leader in the solar supply chain and its systems are crucial to making solar power work.

Source: Wood Mackenzie U.S. PV Leaderboard, Q4 2019

SolarEdge Technologies, Inc. is a U.S.-domiciled, Israel-headquartered provider of power optimizers, solar inverters, and monitoring systems for photovoltaic (PV) arrays for residential and commercial use. We use their inverters and software on our residential projects in San Francisco and have a very positive experience. According to the latest edition of Wood Mackenzie’s 2019 U.S. PV Leaderboard, SolarEdge inverters were used on 60.5 % of U.S. residential installations. More details on their fundamentals can be found here.

In addition to dominating the residential market in the U.S., SolarEdge expanded its footprint in markets like Europe and Australia, moved into the utility-scale inverter, and launched a residential battery storage solution as new growth opportunities. They are also offering a cloud-based virtual power plant (VPP) service, which taps its fleet of smart inverters to control and dispatch distributed energy to address peaks in electricity demand and replace natural-gas-fired peak power sources, currently used by utilities in Vermont, Netherlands, and Australia. SolarEdge continues to expand its product offerings and has acquired an e-mobility and a battery storage company that will contribute to its growth as these technologies evolve.

Photo and PV credit: Jesse Quay, Sun Light & Power, A residential Solar PV installation in San Francisco that uses a SolarEdge inverter.

Pictured (left to right): Ruchi Shah (TNDC), Jesse Quay (Sun Light & Power), and Claro Lesigues (TNDC)

SEDG is also one of the top holdings of the Invesco Solar ETF (TAN) which comprises companies in the solar industry and has produced an annual return of 271% compared to the S&P 500, 17.57%. I invested in SEDG in 2019 and my total average return is over 350%.

Source: Robinhood Markets, Inc.

SEDG currently looks expensive by most traditional financial metrics, like price to earnings (P/E 99.94) or price to sales (P/S 11.30) ratio, but it is a leader in a multitrillion-dollar energy market and may have a lot more growth ahead. Additionally, with the two-year extension of the investment tax credits for solar in the U.S., low-interest rates, and as the president-elect Joe Biden plans to set the U.S on a path to become carbon neutral by 2050, I am optimistic about solar and a greener, low-carbon future. I am certainly in no position to predict the future performance of the stock but I continue to hold my position in SEDG.

Like any normal investor, after realizing spectacular gains, I wished I had invested even more (wishful thinking kicks in). I hope to continue learning more about the energy sector and perhaps find a great opportunity for my next socially responsible investment. Maybe Tesla (is there a right price?), QuantumScape, who knows?

If you’re researching Clean Technology and Renewable Energy sector, I would love to connect via LinkedIn and look forward to hearing about your green investments!

Quick Resources for Green Investments: